PHASE II: Plan and Track Goals

It is astonishing how few Americans have a clearly thought out written financial plan

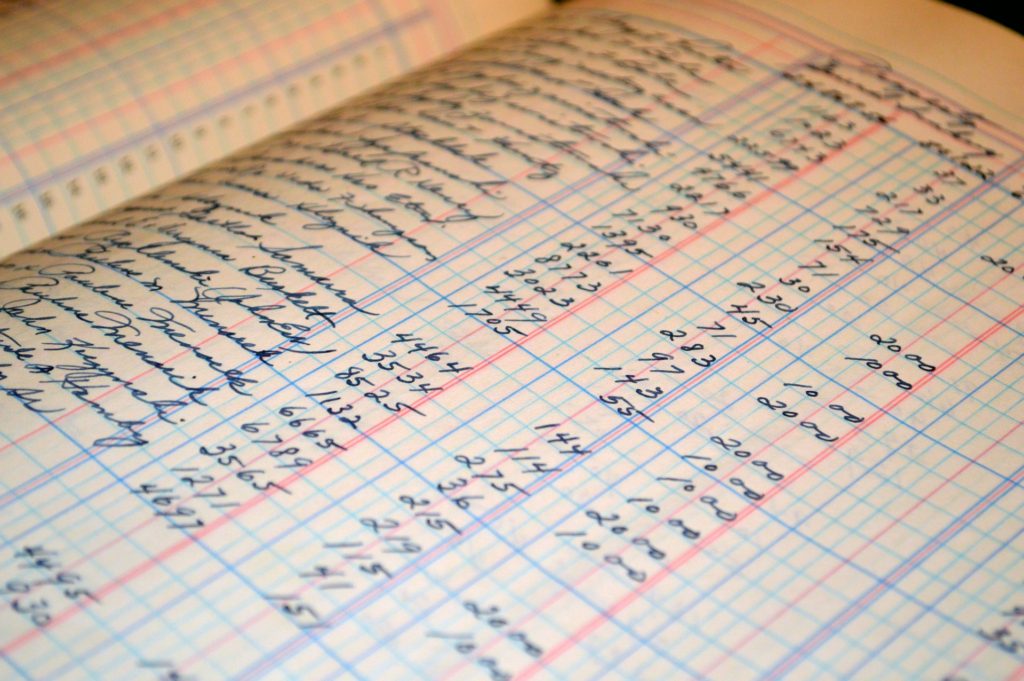

Create a structured financial plan

Step 05: Create a Budget

Planning your spending is key. Having a balanced spending plan should be a financial priority regardless of where you are in life or what your net worth.

Step 06: Track Key Financial Ratios

Some folks feel budgets don’t work. I feel that the process of building and organizing the budget is even more important than having one. Categorizing where your money should and does go is critical.

Apply the same financial discipline we do in business. Financial ratios are used as milestones to track progress as well as compare your progress to other members of your cohort (Age, Gender, Race, Employment Industry, etc.) How else can you know if you’re running as fast as you can/should? Or more, importantly, are you fat at all? I thought I was fast, until I saw Usain Bolts 100m dash time

Step 03: Create a Balance Sheet to track your Net Worth

You should be treating your finances the same way a business does. And one of the first documents every successful business uses to track it’s health is a balance sheet. Why?

Your goal is to grow this one number.

Net Worth is the single most important indicator of financial success and the basis for any financial decisions you make. Your goal should be, at a minimum, to increase net worth on an annual basis.

Step 04: Create an Income Statement to track cash flow

If a net worth is the location, your income of “cash flow” statement is the speed you’re traveling. This is the second number you should be tracking.

Taken together, your net worth and cash flow will help you benchmark your progress against others and yourself. This gives you the vocabulary and common language to communicate.

Recent Comments